Payment of Filing Fee (Check the appropriate box): | | | | | ☒ | | x | | No fee required. | | | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | | | | (1) | | Title of each class of securities to which transaction applies:

| | | (2) | | Aggregate number of securities to which transaction applies:

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | | (4) | ☐ | Proposed maximum aggregate value of transaction:

| | | (5) | | Total fee paid:

| | | ¨ | | Fee paid previously with preliminary material. | | | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | (1) | | Amount previously paid:

| | | (2) | | Form, Schedule or Registration Statement No.:

| | | (3) | ☐ | Filing Party:

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | | | (4) | | Date Filed:

|

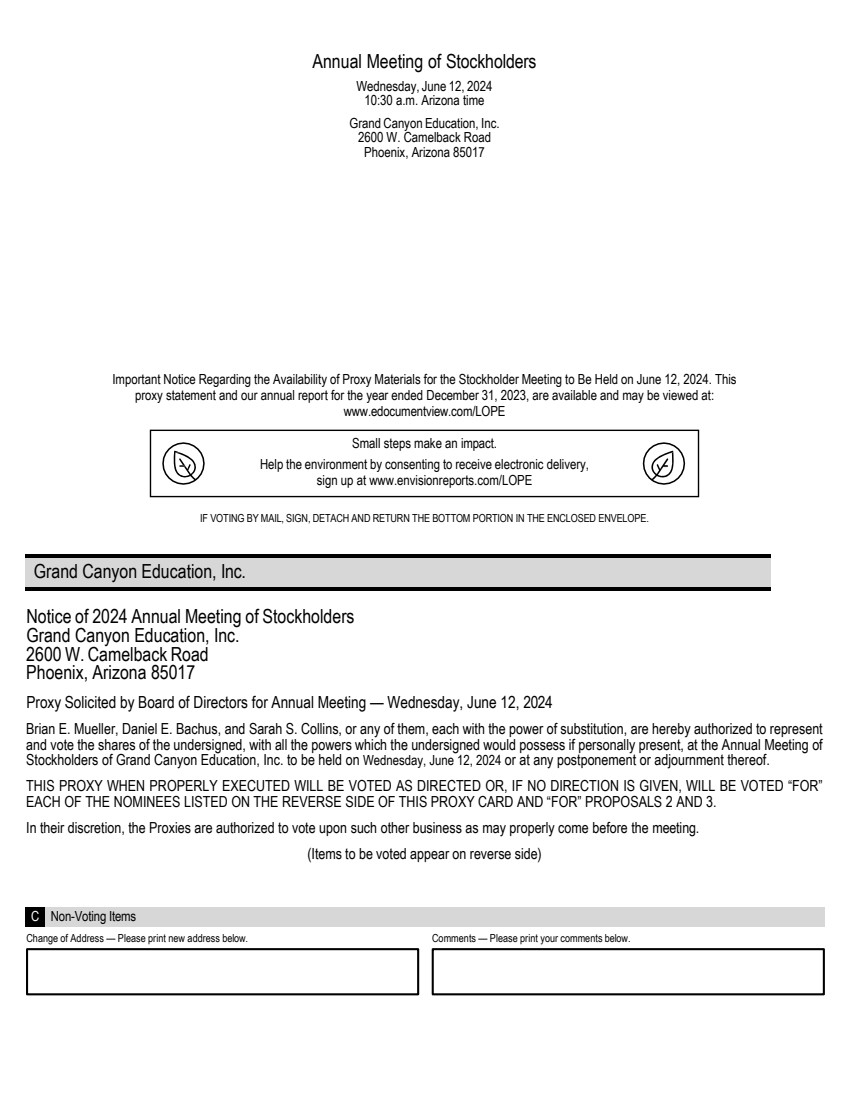

33002600 W. Camelback Road

Phoenix, Arizona 85017 (602) 639-7500247-4400 April 29, 201626, 2024 Dear Stockholder: You are cordially invited to attend the 20162024 Annual Meeting of Stockholders (the “Annual Meeting”) of Grand Canyon Education, Inc. (the “Company” or “GCE”) to be held at Grand Canyon University Arena on the campusoffices of Grand Canyon UniversityGCE located at 33002600 W. Camelback Road, Phoenix, Arizona 85017, commencing at 10:0030 a.m., localArizona time, on Thursday,Wednesday, June 16, 2016.12, 2024. The notice of annual meeting and the proxy statement that follow describe the matters to come before the Annual Meeting. Each holder of record of shares of the Company’s common stock (Nasdaq GM: LOPE) at the close of business on April 22, 201618, 2024 is entitled to receive notice of and to vote at the Annual Meeting, and any adjournment or postponement of the Annual Meeting. Shares of our common stock can be voted at the Annual Meeting only if the holder is present in person or by valid proxy. Our Annual Meeting materials are available over the Internet. We believe that this delivery process expedites stockholders’ receipt of proxy materials as well as lowers the costs and reduces the environmental impact of our Annual Meeting. All stockholders as of the record date were mailed a Notice of Internet Availability (the “Notice”) with instructions on how to access our Annual Meeting materials online and how to request a paper copy of the materials by mail. The Notice also includes instructions on how to vote online or by telephone. Internet voting must be completed before midnight, Mountain Standard Time,Arizona time, prior to the meeting. We hope that you will be able to attend the Annual Meeting in person and we look forward to seeing you.

| Sincerely, | | Brian E. Mueller | Chief Executive Officer and Chairman |

Chief Executive Officer and Director

This proxy statement is dated April 29, 2016,26, 2024 and is first being sent or made available to stockholders on or about May 4, 2016. April 30, 2024.

| a. | On a touch-tone telephone, call toll-free 1-800-652-VOTE (8683), 24 hours a day, seven days a week, through 11:00 p.m. (PT) on June 15, 2016. |

| b. | Please have available your notice card. |

| c. | Follow the simple instructions provided. |

| a. | Go to the web site at www.investorvote.com/LOPE, 24 hours a day, seven days a week, through 11:00 p.m. (PT) on June 15, 2016. |

| b. | Please have available your notice card. |

| c. | Follow the simple instructions provided. |

| 3. | BY MAIL (if you submit your proxy by telephone or Internet, please do not mail your proxy card) |

| a. | Mark, sign and date your proxy card. |

| b. | Return it in the enclosed postage-paid envelope. |

If your shares are held in an account at a brokerage firm, bank or similar organization, you will receive instructions from the registered holder that you must follow in order to have your shares voted.

Your vote is important. Thank you for submitting your proxy.

Notice of Annual Meeting of Stockholders

to be held on June 16, 201612, 2024

To our Stockholders:

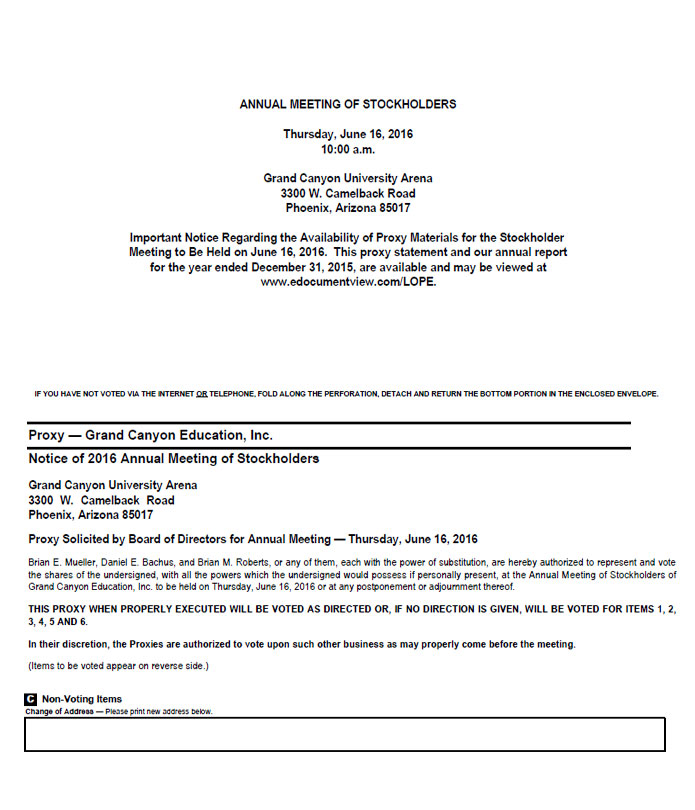

The 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of Grand Canyon Education, Inc. (the “Company”), will be held at Grand Canyon University Arena on the campus of Grand Canyon University at 3300 W. Camelback Road, Phoenix, Arizona 85017, commencing at 10:00 a.m., local time, on Thursday, June 16, 2016, for the following purposes:

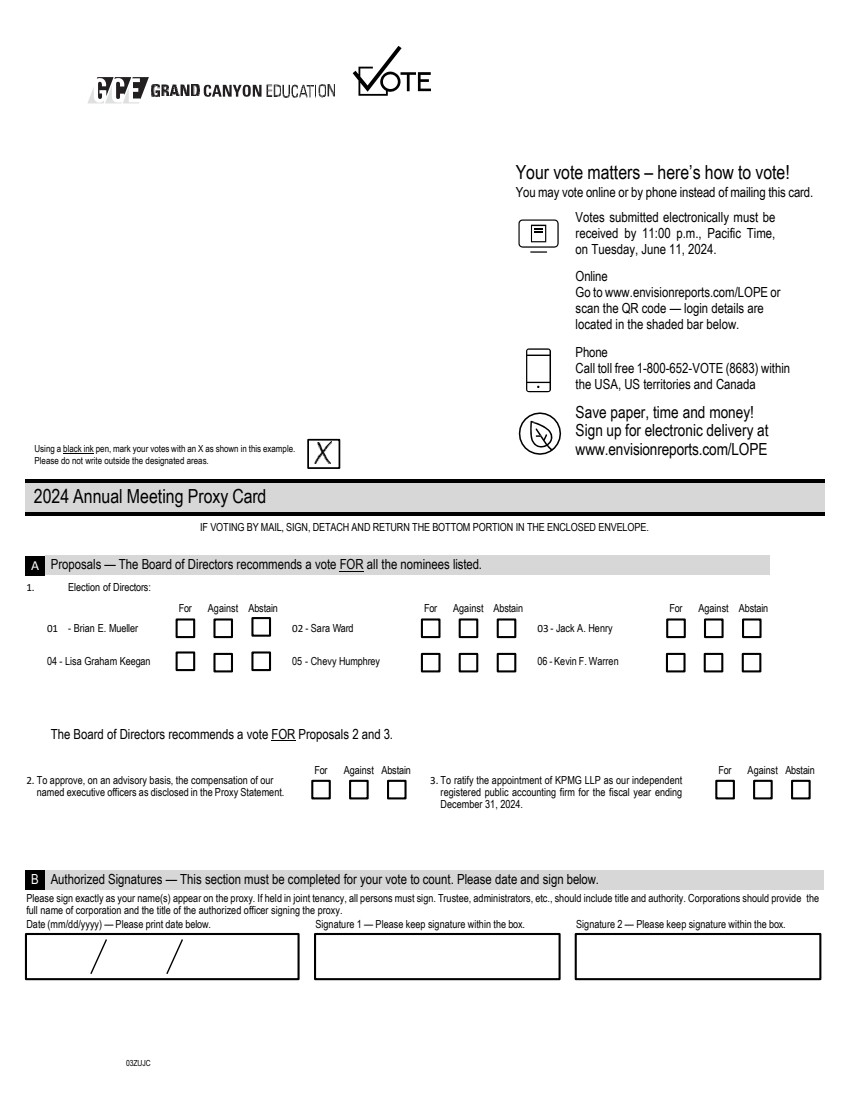

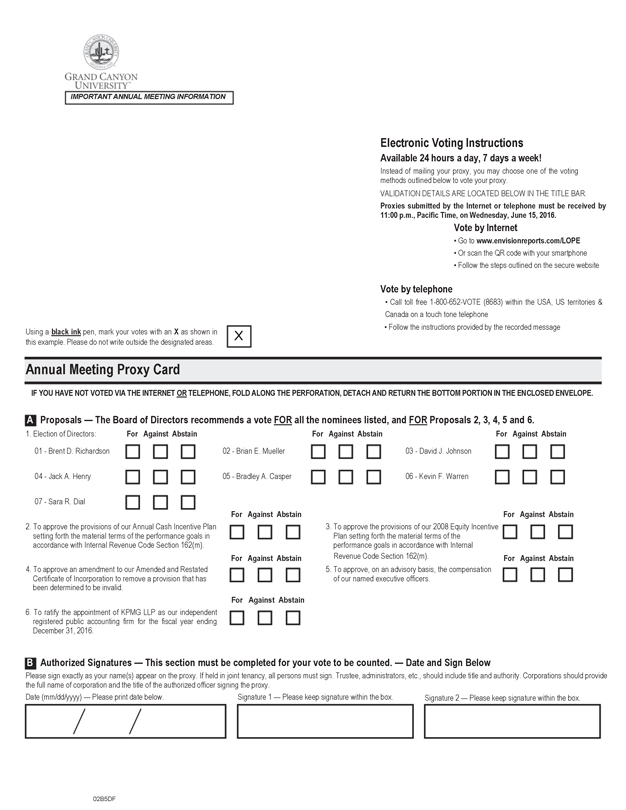

Date and Time: | 1. | Wednesday, June 12, 2024, at 10:30 a.m., Arizona time | | | | Place: | | Grand Canyon Education, Inc. at 2600 W. Camelback Road, Phoenix, Arizona 85017. | | | | Items of Business: | | At the Annual Meeting, holders of our common stock will be asked to consider and vote upon the following proposals, all of which are discussed in greater detail in the accompanying proxy statement: | | | | | | 1. To elect a Board of Directors of sevensix directors, each to serve until the 20172025 annual meeting of stockholders or until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal; |

| 2. | To approve the provisions of our Annual Cash Incentive Plan setting forth the material terms of the performance goals in accordance with Internal Revenue Code Section 162(m); |

| 3. | To approve the provisions of our 2008 Equity Incentive Plan setting forth the material terms of the performance goals in accordance with Internal Revenue Code Section 162(m); |

| 4. | To approve an amendment to our Amended and Restated Certificate of Incorporation to remove a provision that has been determined to be invalid; |

| 5. | 2. To approve, on an advisory basis, the compensation of our named executive officers as disclosed in the enclosed Proxy Statement; |

| 6. | 3. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016;2024; and |

| 7. | 4. To transact such other business as may properly be brought before the meeting or any adjournmentadjournments or postponementpostponements thereof. |

Our Board of Directors has fixed April 22, 2016 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. For 10 days prior to the Annual Meeting, a list of stockholders entitled to vote at the Annual Meeting will be available for inspection in the offices of Grand Canyon Education, Inc., Office of the Chief Executive Officer, 3300 W. Camelback Road, Phoenix, Arizona 85017 between the hours of 8:30 a.m. and 5:00 p.m., local time, each weekday. Such list will also be available at the Annual Meeting.

Your proxy is important to ensure a quorum at the meeting. Even if you own only a few shares, and whether or not you expect to be present, you are urgently requested to submit the enclosed proxy by telephone or through the Internet in accordance with the instructions provided to you. If you received a paper copy of the proxy card by mail, you may also date, sign and mail the proxy card in the postage-paid envelope that is provided. The proxy may be revoked by you at any time prior to being exercised, and submitting your proxy by telephone or through the Internet or returning your proxy by mail will not affect your right to vote in person if you attend the Annual Meeting and revoke the proxy.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on June16, 2016.Our Proxy Statement is attached. Financial and other information concerning Grand Canyon Education, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2015. A complete set of proxy materials relating to our Annual Meeting is available on the Internet. These materials, consisting of the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report to Stockholders, are available and may be viewed at www.edocumentview.com/LOPE.

By Order of the Board of Directors,

Brian E. Mueller

Chief Executive Officer and Director

Phoenix, Arizona

April 29, 2016

| | | | | GENERAL INFORMATION

| | | 1 | | | | Record Date: | | Only stockholders of record at the close of business on April 18, 2024, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. | | | | Delivery of Proxy Materials: | | Beginning on April 30, 2024, we began mailing a Notice of Internet Availability of Proxy Materials to our stockholders rather than a full paper set of the proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials over the Internet, as well as instructions on how stockholders may obtain a paper copy of our proxy materials. | | | | Internet Availability of Proxy Materials: | 1 | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 12, 2024. Our Proxy Statement is attached. Financial and other information concerning Grand Canyon Education, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2023. A complete set of proxy materials relating to our Annual Meeting is available on the Internet. These materials, consisting of the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report to Stockholders, are available and may be viewed at www.edocumentview.com/LOPE. | | | | Voting: | | To make it easier for you to vote, Internet and telephone voting are available. The instructions on the Notice of Internet Availability of Proxy Materials or, if you received a paper copy of the proxy materials, the proxy card describe how to use these convenient services. |

| | | BY ORDER OF THE BOARD OF DIRECTORS | | | Phoenix, Arizona | /s/ BRIAN E. MUELLER | April 26, 2024 | Brian E. Mueller | | Chief Executive Officer and Chairman |

This summary highlights information contained elsewhere in the Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement before voting. For more complete information regarding the Company’s 2023 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. | | GENERAL

INFORMATION | | | A-1 | Date and Time: | Wednesday, June 12, 2024 10:30 a.m., Arizona time | | | Record Date: | April 18, 2024 | | | Place: | Grand Canyon Education, Inc. 2600 W. Camelback Road Phoenix, Arizona 85017 | | | Voting: | The accompanying proxy statement describes important issues affecting Grand Canyon Education, Inc. If you are a stockholder of record as of the record date, you have the right to submit your proxy through the Internet, by telephone or by mail. Please help us save time and administrative costs by submitting your proxy through the Internet or by telephone. Each method is generally available 24 hours a day and will ensure that your voting instructions are confirmed and posted immediately. Stockholders of record as of April 18, 2024 may cast their votes in any of the following ways: |

| | | | | | |

| |

| |

| |

| Internet | | Phone | | Mail | | In Person | Visit www.investorvote.com/LOPE, 24 hours a day, seven days a week, through 11:00 p.m. (PT) on June 11, 2024. Please have available your notice card. Follow the simple instructions provided. | | Call 1-800-652-VOTE (8683), 24 hours a day, seven days a week, through 11:00 p.m. (PT) on June 11, 2024. Please have available your notice card. Follow the simple instructions provided. | | Mark, sign and date your proxy card. Return it in the enclosed postage-paid envelope | | If you plan to attend the meeting in person, you will need to bring a picture ID and proof of ownership of Grand Canyon Education, Inc. common stock as of the record date. |

SUMMARY OF MATTERS TO BE VOTED UPON AND BOARD RECOMMENDATIONS Stockholders are being asked to vote on the following matters at the Annual Meeting: | | | | | | | Proposal |

| Description |

| Board

Recommendation |

| Page Reference for

Further Information: | 1 To elect six directors to our Board of Directors. | | The Board and the Nominating and Corporate Governance Committee believe that the six director nominees possess the necessary qualifications, attributes, skills and experiences to provide quality advice and counsel to the Company’s management and effectively oversee the business and long-term interests of our stockholders. | | “FOR” each director nominee | | 27 | | | | | | | | 2 To approve, on an advisory basis, the compensation of our named executive officers. | | The Company seeks the approval, on an advisory, basis, of the compensation of its named executive officers as described in the Compensation Discussion and Analysis section and the related tables. | | “FOR” | | 32 | | | | | | | | 3 To ratify the appointment of KPMG LLP as our independent registered public accounting firm. | | The Audit Committee and the Board believe that the retention of KPMG LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024 is in the best interests of the Company and its stockholders and we are asking our stockholders to ratify the Audit Committee’s selection of KPMG LLP to serve in that capacity. | | “FOR” | | 58 |

DIRECTOR NOMINEES The following provides summary information regarding our director nominees: Name | | Age | | Director

Since | | Primary Occupation | | Committee Memberships(1) | | Other Public

Company Boards | | | | | | | | | | A | | C | | NCG | | | | Brian E. Mueller* | | 70 | | 2009 | | Chairman of the Board of Directors and Chief Executive Officer, Grand Canyon Education, Inc. | | | | | | | | None | | | | | | | | | | | | | | | | | | Sara Ward+≠ | | 60 | | 2013 | | President and Chief Executive Officer, Sara Dial & Associates | | ⌧ | | ⌧ | | ⌧ | | 1 | | | | | | | | | | | | | | | | | | Jack A. Henry+ | | 80 | | 2008 | | Managing Director, Sierra Blanca Ventures, LLC | | ⌧* | | ⌧ | | ⌧ | | None | | | | | | | | | | | | | | | | | | Lisa Graham Keegan+ | | 64 | | 2019 | | Principal Partner at The Keegan Company | | ⌧ | | ⌧ | | ⌧* | | None | | | | | | | | | | | | | | | | | | Chevy Humphrey+ | | 59 | | 2019 | | President and Chief Executive Officer, Museum of Science and Industry Chicago | | ⌧ | | ⌧* | | ⌧ | | None | | | | | | | | | | | | | | | | | | Kevin F. Warren+ | | 60 | | 2024 | | President and Chief Executive Officer of the Chicago Bears Football Club | | ⌧ | | ⌧ | | ⌧ | | None | |

≠ | Lead independent director |

| (1) | A= Audit Committee; C=Compensation Committee; and NCG=Nominating and Corporate Governance Committee |

OUR CORPORATE GOVERNANCE HIGHLIGHTS We believe that effective corporate governance is critical to our ability to create long term value for our stockholders. The following highlights certain key aspects of our corporate governance framework: | | | | | |

| ◻ | We Have An Independent and Diverse Board. Five of our six directors are independent. Three of our six directors are women and two of our directors identify with an underrepresented diverse race or ethnicity. |

| ◻ | Our Independent Directors Meet Without Management. Our independent directors meet regularly in executive sessions without management present. | | | | | | | | ◻ | We Have Majority Voting for Directors. We have adopted majority voting for directors pursuant to which nominees who fail to achieve an affirmative majority of votes cast must submit their resignation. | | ◻ | We Have a Stock Ownership Policy. We require both our named executive officers and our directors to maintain a meaningful ownership stake at levels specified in our stock ownership policy. | | | | | | | | ◻ | We Hold Annual Elections for Directors. We do not have a staggered board. | | ◻ | Our Key Committees are Independent. We have fully independent Audit, Compensation and Nominating and Corporate Governance Committees. | | | | | | | | ◻ | We Assess Board Performance. We conduct regular evaluations of our Board and Committees. | | ◻ | We Do Not Have a “Poison Pill.” We do not maintain a stockholder rights plan. | | | | | |

SOCIAL RESPONSIBILITY AND HUMAN CAPITAL DEVELOPMENT The Company seeks to meet the needs of the local community in which we operate as well as those outside our community, particularly the education challenges that our country faces, and then works to find solutions to these challenges. We believe these challenges include: university education is too expensive; students are taking on too much debt to pay for their education; bachelor degrees are taking too long to complete; programs are not targeted enough toward careers; as tuition increases, diversity decreases; universities have inadequate counseling and support services, especially for distanced learners; most university professors have no formal training in teaching, learning or course design; and universities are under significant financial pressures. These challenges have been enhanced due to a declining number of high school graduates attending college. We believe we provide the capital, technology and expertise to our university partners to alleviate the challenges in each of the areas listed above. We work with these university partners to develop educational models that allow them the ability to decrease tuition or increase scholarships to their students which will often lower the debt their students incur. We work with our university partners and thousands of high schools across the country on dual credit, online prerequisite courses and other programs that shorten the time to completion thereby lowering cost and debt levels. We focus with our university partners and their local communities to develop programs where there are skills shortages such as healthcare, teacher education, science, technology, engineering and math. We provide expanded academic counseling services and support to the students of our university partners which has proven to increase retention and completion. Our faculty services and curriculum development teams assist not only our university partners but other universities and K-12 schools in improving their online education pedagogy. Our business model has helped our university partners succeed through the various changes in the educational landscape that have put pressure on their financial condition and operations. We also participate with our employees in a number of activities to benefit our communities including: | | | | | ● Improving Our Neighborhood and Increased Home Values. Together with Habitat for Humanity and in concert with our largest university partner, Grand Canyon University (“GCU”) we are participating in the largest home renovation project in the country in the West Phoenix area surrounding our most significant university partner’s campus. As of December 31, 2023, 1,388 projects have been completed in which 35,250 hours have been logged by volunteers. These efforts, combined with GCE and GCU’s expanded presence in the community, have contributed to a significant increase since 2011 in home values in the surrounding area. | | ● Continuing Community Involvement. GCE and our employees partner in countless community events and projects throughout the year. The Company offers its full-time employees a maximum of 16 hours of PTO annually for community service. This time is used to volunteer at more than 40 approved charitable organizations. ● Youth Opportunity Foundation. We donate time and funds to the Youth Opportunity Foundation which provides advocacy, clinical treatment, education and workforce development for at-risk young people in underprivileged areas. | | ● Furthering Job Creation. We, along with GCU have launched a number of new business enterprises that have reduced costs, provided management opportunities for recent graduates and employment opportunities for students and neighborhood residents, while spurring economic growth in the area. | | ● Encouraging Employee Giving. We participate in Donate to Elevate, a program that encourages employees to contribute money in lieu of state income tax payments to benefit private schools in Arizona and the partnership with Habitat for Humanity and GCU CityServe, as well as local public schools and public charter schools. |

| ● Sponsoring K-12 Educational Development. GCE supports GCU’s K-12 Educational Development Department through sponsorship of GCU Canyon Professional Development and K-12 Targeted School Assistance programs. Canyon Professional Development offers professional development opportunities for educators and administrators, and their student/parent engagement programs aim to help students become college ready. K-12 Targeted School Assistance programs also offer tutoring and mentorship and more to community schools to improve learning environments and outcomes. | | ● Funding of Student Tuition Organizations. The Company contributes to private school tuition organizations and in 2023 its annual contribution was $3.5 million. Financial contributions are allocated toward tuition assistance and awarding low-income Arizona students with scholarships to attend Arizona private schools. ● Students Inspiring Students.GCE continues to support GCU’s free tutoring/mentoring program that serves Phoenix-area K-12 schools. Students who seek academic assistance in the GCU Learning Lounge may become eligible to receive the Students Inspiring Students full-tuition scholarship. To serve our clients and community, GCE seeks donations to fund this neighborhood scholarship program. |

Our Diverse Workforce The Company believes that it must have the best talent, including employees who possess a diverse range of experiences, backgrounds and skills, in order to anticipate and meet the needs of our business and those of our university partners. Over time, we have hired, developed and retained a diverse management and workforce that reflects our surrounding community and that is a key component in GCE’s success and an important part of the Company’s culture. We provide employees with training, development, and educational resources that promote learning and lead to real career advancement opportunities. We believe that our success in attracting, retaining, and developing human capital is directly correlated to our ability to provide employees both an interesting and engaging work experience as well as opportunities for meaningful involvement in the surrounding community. A growing body of evidence suggests that diverse teams improve financial outcomes and support innovation, resiliency, and productivity. GCE’s commitment to fostering diversity among its workforce in its community is evident in the following: | ● | Our ability to attract, develop and retain diverse talent is reflected at both the Board and management levels.Three of our six directors are women, and two of our directors identify with an underrepresented diverse race or ethnicity. In addition, as of December 31, 2023, 72.2% of the positions at the Company at the level of manager and above, totaling 618 persons, were held by women and other diverse persons, an increase of 4.9% over 2022, and 83.2% of our 5,800 total employees were women and other diverse persons, an increase of 4.1% over 2022. |

| ● | GCE maintains hiring policies and practices that support diversity such as an Equal Employment Opportunity Policy, Nondiscrimination and Anti-Harassment Policy and Complaint Procedure, and a Disability Accommodation Policy. We post all open positions to a variety of diversity-related job boards to ensure we attract a wide pool of candidates. We also collect and analyze employee demographic data to identify current trends and areas of opportunity in regard to our diversity efforts. |

| ● | GCE provides employees and management with regular diversity training. New hires all complete anti-discrimination and harassment training within three months of starting at GCE. Thereafter, all employees complete the training every other year, while management undertakes it annually. We have also provided Implicit Bias Training to all employees. |

| ● | GCE provides learning and development support to our employees through numerous Employee Learning and Development (“ELD”) initiatives. Onboarding Programs provide new employees a foundation from which one can progress in his or her career at GCE. Leadership Development, Team Development, Advanced Skills, and Self-Development Programs help employees improve their skills, assist management in identifying potential talent for leadership roles, and support those employees already in leadership roles. Finally, our Compliance Curriculum ensures that employees stay current with regulatory and other compliance requirements. These programs and curricula are offered virtually on both a synchronous and self-paced basis. |

| ● | GCE promotes the concept of lifelong learning and supports this concept by offering its employees a generous Tuition Benefit program through its most significant university partner, GCU. After three months of continuous service, fulltime employees admitted to GCU receive a 100% tuition reduction on undergraduate and graduate programs. Additionally, the tuition benefit is available for an eligible employee’s spouse or up to two children with no more than two participants receiving the benefits at any one time. An eligible employee’s spouse or child admitted to GCU receives a 100% tuition reduction on undergraduate programs and a 50% tuition reduction on graduate programs. |

| ● | GCE monitors employee engagement and satisfaction through an annual survey. GCE received responses from 1,835 employees on the 2022 survey. The survey asked a number of questions regarding employee engagement and satisfaction including whether employees are actively engaged with their work, whether they have a sense of pride in what they do and whether they enjoy the type of work assigned to them. The responses to each question were overwhelmingly positive. For example, to the prompt, “Overall I am satisfied with GCE as an employer,” fewer than 10% of the responders disagreed with that statement, while 92% of those responses agreed that GCE enables a culture of diversity. This survey also inquired about the importance of Environmental, Social and Governance topics that employees feel are important to GCE business performance and financial success. The top five selected in the survey by employees were Employee Health and Wellbeing (56%), Community Engagement (55%), Human Capital Management (51%), Workforce Diversity and Engagement (33%) and Professional Integrity (32%). |

ENVIRONMENTAL AWARENESS Online education is inherently more environmentally friendly than traditional campus education due to a reduction in greenhouse gas production caused by avoiding traveling to and from a brick-and-mortar campus. It also increases student capacity while eliminating the need for construction of a physical campus. A majority of our university partners’ students are enrolled in hybrid or online educational models. In addition, a significant number of our university partners’ students utilize an ebook format versus paper textbooks, which is more environmentally friendly in that it saves paper and other material and there is no shipment required. The Company owns, and operates its business from, a four-story 325,000 square foot administrative building, which includes office space for approximately 2,700 employees and a parking garage. We constructed these facilities in 2016 and, as with every one of our projects over the past ten years, we designed them to maximize energy efficiency and minimize electricity usage and environmental impact. Our headquarters building includes the following design features: | | | | ◻ | North/South Building Orientation. The Company’s office building is orientated with north/south exposure in order to minimize direct sun and thereby reduce power usage. Exterior courtyards were arranged to ensure summer shade thus creating outdoor areas that can be used by our employees throughout the year. | ◻ | Reducing Water Consumption. Water usage is another environmental factor for office space that is magnified by the Arizona sun. The Company’s office building utilizes numerous water conservation methods including push-tap faucets, waterless urinals, and a rooftop rain water collection system for irrigating the landscaping below, which significantly reduces our water consumption. |

| | | | ◻ | Use of Window Glazing. Our building utilizes significant window glazing to allow for daylighting thus reducing the need for supplemental electrical lighting. As a result, the building is designed to use just .41 watts per square foot of electrical energy for lighting, which is half of what a typical environmentally efficient building uses. | ◻ | Other Design Features. Additional environment-friendly design features include low VOC paints, use of recycled building materials, interior and exterior LED light bulbs, motion sensor lighting and implementation of an energy-efficient VRF mechanical system. |

In addition to its efficient facilities, the Company has undertaken other measures to minimize its environmental impact, including, among others: | ● | Allowing a significant portion of our diverse workforce to continue to work remotely; |

| ● | implementing a Trip Reduction Program, which provides incentives to employees who participate in carpooling or take public transportation to work; |

| ● | providing a telecommute option for a significant number of positions; and |

| ● | participating in a recycling program aimed at minimizing the volume of waste products generated by the Company. |

This has resulted in savings in the areas of waste, janitorial costs, and travel costs related to business travel and commuting. Climate Disclosures We do not operate in a high-risk industry for climate risks. We believe that we have low climate risk with respect to our physical environment (e.g. fires, drought, hailstorms, increasing weather pattern changes). A significant portion of our workforce is continuing to work remotely. We have insurance policies in place to cover any damage for our property, plant and equipment. Our Audit Committee is tasked with oversight of climate-related risks for the Company. We are evaluating emissions reduction requirements with key suppliers for costs such as information security systems, communication and marketing costs, travel costs, and continued expansion of our off-campus classroom and laboratory sites. We currently do not have any regulatory emissions reporting obligations. We do not have significant risk from a transition to a low-carbon economy, which could result in changing customer behavior. Our customers are university partners located in the United States. Cybersecurity Our Audit Committee is tasked with oversight of the cybersecurity controls in place at the Company. The Company employs a dedicated Chief Information Security Officer, with an experienced and competent security team, and works closely with the Chief Risk Officer to provide risk reporting and ensure security and compliance. The Company regularly engages third party experts to perform cybersecurity assessments. These assessments are normally performed on an annual basis. Reports are sent to the Audit Committee monthly, and Security, Risk and Compliance updates are provided quarterly. The Company has implemented policies and procedures for all employees including: | ● | Information security/cybersecurity policies, which are internally available for all employees; |

| ● | Information security/cybersecurity awareness training; |

| ● | A clear escalation process which employees can follow in the event an employee notices something suspicious; and |

| ● | Ensuring that information security/cybersecurity is part of the employee performance evaluations and/or disciplinary actions. |

The Company maintains a cyber insurance policy. The Company has not had a security breach and has not incurred any material expenses for a security breach in the past three years. Other Corporate Policy Matters We maintain a whistleblower hotline available to both internal and external parties. The whistleblower policy is disclosed on the GCE intranet for employees and disclosed on the GCE investor relations website for external parties. Hotline activity is managed by a third party and all calls are reviewed and monitored by the Chief Risk Officer and General Counsel and discussed at the quarterly Audit Committee meetings. Questions and Answers Please see the General Information section for important information about the proxy materials, voting, the annual meeting, Company documents, communications and the deadlines to submit stockholder proposals and director nominees for the 2024 Annual Meeting of Stockholders. Additional questions may be directed to our General Counsel, Grand Canyon Education, Inc., 2600 W. Camelback Road, Phoenix, Arizona 85017. 3300Learn More About Our Company

You can learn more about the Company, view our governance materials and much more by visiting our website, www.gce.com. Grand Canyon Education, Inc. 2600 West Camelback Road Phoenix, Arizona 85017 PROXY STATEMENT

GENERAL INFORMATION The enclosed proxy is being solicited by our Board of Directors for use in connection with the Annual Meeting to be held on Thursday,Wednesday, June 16, 2016,12, 2024, at Grand Canyon University Arena on the campusoffices of Grand Canyon UniversityEducation, Inc. located at 33002600 W. Camelback Road, Phoenix, Arizona 85017, commencing at 10:0030 a.m., localArizona time, and at any adjournment or postponement thereof.

Notice of Internet Availability In accordance with the electronic delivery rules adopted by the Securities and Exchange Commission (“SEC”), the Company is permitted to furnish proxy materials to its stockholders on the Internet, in lieu of mailing a printed copy of proxy materials to each stockholder of record. You will not receive a printed copy of proxy materials unless you request a printed copy. The Notice, which was made availablefirst mailed to our stockholders on or about May 4, 2016,April 30, 2024, instructs you as to how you may access and review on the Internet all of the important information contained in the proxy materials. The Notice also instructs you as to how you may vote your proxy. If you received a Notice by mail and would like to receive a printed copy of the Company’s proxy materials and annual report, you must follow the instructions for requesting such materials included in the Notice. Alternatively, you may download or print these materials, or any portion thereof, from any computer with Internet access and a printer. The Company believes this process provides its stockholders the information they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and delivering the proxy materials. To access the Company’s proxy statement and annual report electronically, please visitwww.edocumentview.com/LOPE or the Company’s Investor Relations website atwww.gcu.eduwww.gce.com.

Record Date and Quorum Only stockholders of record at the close of business on April 22, 2016,18, 2024, will be entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. At the close of business on the record date, we had approximately 46,619,00929,784,803 shares of our common stock outstanding and entitled to vote, with each such outstanding share entitled to one vote per share on each matter to be voted upon by stockholders. A majority of the shares outstanding on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the meeting.

Submission of Proxies; Revocation All valid proxies received prior to the Annual Meeting will be exercised. All shares represented by a proxy will be voted, and where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. You may revoke your proxy at any time before it is exercised by submitting to our Secretary a written notice of revocation, submitting a properly executed proxy bearing a later date, voting by telephone or via the Internet at a later time (if initially able to vote in that manner) so long as such vote or voting direction is received by the applicable date and time set forth above for stockholders of record, or by attending the Annual Meeting and voting in person. If you hold your shares through a bank, broker, trustee or nominee and you have instructed the bank, broker, trustee or nominee to vote your shares, you must follow the directions received from your bank, broker, trustee or nominee to change those instructions.

Deadlines for Stockholder Proposals Stockholder proposals may be included in our proxy materials for an annual meeting so long as they are provided to us on a timely basis and satisfy certain other conditions established by the Securities and Exchange Commission (the “SEC”),SEC, including specifically under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be timely, a proposal to be included in our proxy statement must be received at our principal executive offices, addressed to our Secretary, not less than 120 calendar days before the first anniversary of the date that our proxy statement was released to stockholders in connection with the previous year’s annual meeting. Accordingly, for a stockholder proposal to be included in our proxy materials for our 20172025 Annual Meeting of Stockholders, the proposal must be received at our principal executive offices, addressed to our Secretary, not later than the close of business on January 4, 2017.Tuesday, December 31, 2024. Subject to certain exceptions, stockholder business that is not intended for inclusion in our proxy materials may be brought before an annual meeting so long as we receive notice of the proposal as specified by, and subject to the conditions set forth in, our bylaws, addressed to our Secretary at our principal executive offices, not earlier than the close of business on the 120th 120th day, nor later than the close of business on the 90th 90th day, prior to the first anniversary of the date of the preceding year’s annual meeting.meeting as first specified in the Company’s notice of meeting (without regard to any postponements or adjournments of such meeting after such notice was first sent), except that if no annual meeting was held in the previous year or the date of the annual meeting is more than 30 days earlier or later than such anniversary date, notice by the stockholders to be timely must be received not later than the close of business on the later of 90th day prior to the annual meeting or the 10th day following the date on which public announcement of the date of such meeting is first made. For our 20172025 Annual Meeting of Stockholders, proper notice of business that is not intended for inclusion in our proxy statement must be received not earlier than the close of business on Thursday, February 16, 2017,13, 2025, nor later than the close of business on Thursday, March 18, 2017.14, 2025. A stockholder’s notice to our Secretary must set forth as to each matter the stockholder proposes to bring before the meeting (i) a brief description of the business desired to be brought before the meeting and the text of the proposal or business, including the text of any resolutions proposed for consideration and, in the event that such business includes a proposal to amend the Company’s bylaws, the language of the proposed amendment, (ii) the name and address, as they appear on the Company’s books, of the stockholder proposing such business and the names and addresses of the beneficial owners, if any, on whose behalf the business is being brought, (iii) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at the meeting on the date of such notice and intends to appear in person or by proxy at the meeting to propose the business specified in the notice, (iv) any material interest of the stockholder and any such other beneficial owner in such business, and (v) the following information regarding the ownership interests of the stockholder or any such other beneficial owner, which shall be supplemented in writing by the stockholder not later than ten (10) days after the record date for voting at the meeting to disclose such interests as of such record date: (A) the class and number of shares of the Company that are owned beneficially and of record by the stockholder and any such other beneficial owner;(B) any “derivative instrument” (which is defined as any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived in whole or in part from the value of any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise directly or indirectly owned beneficially by such stockholder and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company); (C) any proxy, contract, arrangement, understanding, or relationship pursuant to which such stockholder has a right to vote any shares of any security of the Company; (D) any short interest in any security of the Company (meaning a person shall be deemed to have a short interest in a security if such person, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has the opportunity to profit or share in any profit derived from any decrease in the value of the subject security); (E) any rights to dividends on the shares of the Company owned beneficially by such stockholder that are separated or separable from the underlying shares of the Company; (F) any proportionate interest in shares of the Company or derivative instruments held, directly or indirectly, by a general or limited partnership in which such stockholder is a general partner or, directly or indirectly, beneficially owns an interest in a general partner; and (G) any performance-related fees (other than an asset-based fee) to which such stockholder is entitled based on any increase or decrease in the value of shares of the Company or derivative instruments, if any, as of the date of such notice, including, without limitation, any such interests held by members of such stockholder’s immediate family sharing the same household.

Quorum The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum for the transaction of business at the meeting. Abstentions and broker non-votes are included in determining whether a quorum is present. Abstentions include shares present in person but not voting and shares represented by proxy but with respect to which the holder has abstained. Broker non-votes occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power on that item and has not received instructions from the beneficial owner.

Vote Required If you hold your shares in “street name,” and you do not give your bank, broker or other holder of record specific voting instructions for your shares, your record holder can vote your shares on routine matters, which include only the approval ofproposal to ratify the amendment to the Amended and Restated Certificate of Incorporation and the ratificationappointment of our independent registered public accountants.accounting firm (Proposal No. 3). However, your record holder cannot vote your shares without your specific instructions on the election of directors (Proposal No. 1), or on matters related to executive compensation, including the advisory votevotes described below on the compensation of our named executive officers.officers (Proposal No. 2). If you hold your shares in “street name,” please refer to the information forwarded by your bank, broker or other holder of record for procedures on revoking or changing your proxy. In the absence of instructions, shares subject to such broker non-votes will not be counted as voted or as present or represented on any of the proposals offered at the Annual Meeting other than ratification of our auditors and so will have no effect on the vote.We encourage you to provide instructions to your bank, broker or other holder of record regarding the voting of your shares. Our stockholders have no dissenter’s or appraisal rights in connection with any of the proposals described herein. Election of Directors. The affirmative vote of a majority of the votes cast with respectrequired to a nominee is required for the election to the Board of Directors ofapprove each of the nominees for director. Forproposals presented in this purpose, “a majority of the votes cast” means that the number of shares voted “for” a nominee exceeds the number of votes cast “against” that nominee. Stockholders do not have the right to cumulate their votes in the election of directors. Abstentions and broker non-votes will have no effect on the outcome of the election because abstentions and broker non-votes are not considered to be votes cast.

Approve the provisions of our Annual Cash Incentive Plan settingProxy Statement is set forth the material terms of the performance goals in accordance with Internal Revenue Code Section 162(m). Approval of the award limitations within our Annual Cash Incentive Plan requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal.below:

Approve the provisions of our 2008 Equity Incentive Plan setting forth the material terms of the performance goals in accordance with Internal Revenue Code Section 162(m). Approval of the grant limitations within our 2008 Equity Incentive Plan requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal.

Approve the amendment to our Amended and Restated Certificate of Incorporation. Approval of the amendment to our Amended and Restated Certificate of Incorporation requires the affirmative vote of the majority of shares entitled to vote. Abstentions and broker non-votes will have the effect of a vote against this proposal.

Advisory vote on the compensation of our named executive officers.Approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal. Although this vote is advisory and is not binding on our Board of Directors, the Board of Directors and the Compensation Committee will consider the voting results, along with other relevant factors, in connection with their ongoing evaluation of our compensation program.

Ratification of the appointment of the Independent Registered Public Accounting Firm.Approval of the proposal to ratify the Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal.

| ● | Election of Directors (Proposal No. 1). The affirmative vote of a majority of the votes cast with respect to a nominee is required for the election to the Board of Directors of each of the nominees for director. For this purpose, “a majority of the votes cast” means that the number of votes cast “for” a nominee exceeds the number of votes cast “against” that nominee. Stockholders do not have the right to cumulate their votes in the election of directors. Abstentions and broker non-votes will have no effect on the outcome of the election because abstentions and broker non-votes are not considered to be votes cast. |

| ● | Approval, on an advisory basis, of the compensation of our named executive officers (Proposal No. 2). Approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, while abstentions will have the effect of a vote against this proposal. Although this vote is advisory and is not binding on our Board of Directors or Compensation Committee, the Board of Directors and the Compensation Committee will consider the voting results, along with other relevant factors, in connection with their ongoing evaluation of our compensation program. |

| ● | Ratification of the appointment of the Independent Registered Public Accounting Firm (Proposal No. 3). Approval of the proposal to ratify the Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Brokers have discretion to vote on the ratification of our independent auditors and, as such, no votes on this proposal will be considered broker non-votes. Abstentions will have the effect of a vote against this proposal. |

Adjournment or Postponement of Meeting The Annual Meeting may be adjourned or postponed to any other time and to any other place at which a meeting of stockholders may be held by the chairman of the Annual Meeting or, in the absence of such person, by any officer entitled to preside at or to act as Secretary of the Annual Meeting, or by the holders of a majority of the shares of stock present or represented by proxy at the meeting and entitled to vote, although less than a quorum.

Expenses of Soliciting Proxies We will bear the cost of soliciting proxies. In addition to solicitation by the use of mail or via the Internet, certain directors, officers and regular employees may solicit proxies by telephone or personal interview. None of such persons will receive any additional compensation for their services. CORPORATE GOVERNANCE AND BOARD MATTERS

Corporate Governance Philosophy The business affairs of the Company are managed under the direction of the Board of Directors in accordance with the Delaware General Corporation Law, as implemented by the Company’s certificate of incorporation and bylaws. The role of the Board of Directors is to effectively govern the affairs of the Company for the benefit of its stockholders and other constituencies. The Board of Directors strives to ensure the success and continuity of business of the Company through the selection of qualified management. It is also responsible for ensuring that the Company’s activities are conducted in a responsible and ethical manner. The Company is committed to having sound corporate governance principles.

Changes to the Board of Directors During 2023 and 2024 The Corporate Governance Principles and Practices of Grand Canyon Education, Inc. (the “Company”) require that a director tender his or her resignation for consideration by the Nominating and Corporate Governance Committee of the Board of Directors upon ceasing to be actively employed in his or her principal business or profession. In accordance with this policy, Mr. David M. Adame, a director since 2021, tendered his resignation for consideration in light of his resignation as President and Chief Executive Officer of Chicanos por la Causa. Effective December 15, 2023, the Board of Directors, acting on the recommendation of the Nominating and Corporate Governance Committee, accepted Mr. Adame’s resignation. Mr. Adame’s decision to resign was not due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. On April 24, 2024, upon the recommendation of the Nominating and Corporate Governance Committee, Mr. Kevin F. Warren, who previously served on the Board of Directors from September 2012 until August 2019, was appointed to the Board of Directors and to serve as a member of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Board of Directors Meetings and Attendance During our 20152023 fiscal year, our Board of Directors held six meetings and eachfive meetings. All of our directors attended 100% of such meetings.meetings, except for Mr. David M. Adame who attended 100% of such meetings until he tendered his resignation in October 2023. We do not have a formal policy regarding attendance of our directors at annual meetings of our stockholders, but we do encourage each of our directors to attend. SixAll of our seven directors in 2023 attended our 20152023 annual meeting.meeting in person or telephonically.

Director Independence Our Board of Directors periodically, and no less frequently than annually, reviews the independence of each director. During these reviews, our Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and management to determine whether any such transactions or relationships are inconsistent with a determination that the director was independent. Our Board of Directors has affirmatively determined that each director other than Brent D. Richardson, who served as our Executive Chairman until June 2015 and currently serves as our non-executive Chairman of the Board, and Brian E. Mueller, who serves as our Chief Executive Officer, is “independent,” as defined by the Marketplace Rulesrules of the Nasdaq Stock Market. Under the Marketplace Rules,Nasdaq Stock Market rules, a director can be independent only if the director does not trigger a categorical bar to independence and our Board of Directors affirmatively determines that the director does not have a relationship which, in the opinion of our Board of Directors, would interfere with the exercise of independent judgment by the director in carrying out the responsibilities of a director. Board Leadership Structure We currently separateThe Company’s governance framework provides the rolesBoard with flexibility to select the appropriate Board leadership structure for the Company. In making leadership structure determinations, the Board considers many factors, including the specific needs of Chief Executive Officerthe business and what is in the best interests of the Company’s stockholders. Having the flexibility to select the appropriate structure based on the specific needs of the business is critical, and it is part of the judgment the Board believes it should exercise. The Board understands that Board leadership structure is an important topic for many stockholders, and the Board takes stockholder feedback into account when making determinations around Board leadership structure.

Our Board leadership structure comprises a “combined” Chairman of the Board and Chief Executive Officer, a lead independent director, Board committees led entirely by independent directors and active engagement by all directors. In selecting Mr. Mueller to serve as Chairman, the Board determined that having Mr. Mueller serve in recognitionthe combined role provides certain synergies and efficiencies that can serve to enhance the functioning of the differences betweenBoard and serve the two roles.business and stockholders well over time. The Company operates in a complex business and regulatory environment, which requires a chief executive officer with deep knowledge of the business and the industry within which we operate. Because the Chief Executive Officer is responsible for setting the strategic direction forBoard member closest to our complex business, he is best able to identify many of the business issues that need to be on the Board agenda, and, as Chairman of the Board, he can focus directors’ attention on the most critical business matters. Further, the Board believes that, at this time, a combined Chairman of the Board and Chief Executive Officer will facilitate timely and unfiltered communication with the Board on critical business and regulatory issues. The Board also believes that there are benefits in having the same person represent both the Company and the dayBoard with regulators, stockholders and other stakeholders. In accordance with our Corporate Governance Principles and Practices, in the event the positions of Chairman and Chief Executive Officer are held by the same person, or if the position of Chairman is also held by a non-independent person, a lead independent director is appointed annually by the affirmative vote of a majority of those directors who have been determined to day leadership and performancebe “independent” under applicable Nasdaq guidelines. The lead independent director, a position currently held by Ms. Sara Ward, has the following duties: | ● | Setting the agenda and serving as chairman for the executive sessions of the independent directors. |

| ● | Serving as liaison between the Chairman and the independent directors, including, communicating to the Chairman, as appropriate, the results of executive sessions of the independent directors. |

| ● | Ensuring that independent directors have adequate opportunities to meet without management present, including authority to call meetings of the independent directors. |

| ● | Serving as designated contact for communication to independent directors as required by the Securities and Exchange Commission and the Nasdaq Stock Market’s listing standards, including being available for consultation and direct communication with major stockholders. |

| ● | Approving the agenda and information sent in connection with Board meetings and ensuring that the other independent directors also have an opportunity to provide input on the agenda. |

| ● | Approving meeting schedules to assure that there is sufficient time for discussion of all agenda items. |

| ● | Chairing Board meetings if the Chairman is unable to attend. |

Importantly, all of our directors play an active role in overseeing the Company, while the Chairman ofCompany’s business both at the Board provides guidance toand committee levels. As part of each regularly scheduled Board meeting, the independent directors meet in executive session without the Chief Executive Officer present. These sessions allow our independent directors to discuss issues of importance to the Company, including the business and sets the agenda for Board meetings and presides over meetings of the full Board. Currently, the Board believes that Mr. Richardson’s role as Chairman ensures a greater role for the non-management directors in the oversightaffairs of the Company and encourages greater participationas well as matters concerning management, without any member of the non-management directors in setting agendas and establishing priorities and procedures for the work of the Board.Because Mr. Richardson served as an employee of the Company until June 2015 and is therefore not “independent,” our Board of Directors has appointed the Chairman of our Compensation Committee, Mr. David J. Johnson, as “lead independent director” to preside at executive sessions of “non-management” directors. The Board generally seeks to hold executive sessions twice a year.management present.

Committees of Our Board of Directors During 2023 Our Board of Directors directs the management of our business affairs, as provided by Delaware law, and conducts its business through meetings of the Board of Directors. Our Board of Directors has established three standing committees: an Audit Committee;Committee, a Compensation Committee;Committee, and a Nominating and Corporate Governance Committee. EachDuring 2023, each director attended 100% of the meetings of the Board committees on which such director he or she served. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues. The composition of the Board committees complies with the applicable rules of the Nasdaq Stock Market and applicable law. Our Board of Directors has adopted written charters for each of the standing committees, which are available in the Corporate Governance section of the Investor Relations page on our website atwww.gcu.eduwww.gce.com. Audit Committee(Number of meetings held during 2023: Five). OurDuring 2023, our Audit Committee consistsconsisted of Messrs. Jack A.Mr. Henry (chair), Kevin F. Warren,Ms. Ward, Ms. Keegan, Ms. Humphrey and Bradley A. Casper,Mr. Adame, each of whom our Board of Directors has determined isto be “independent,” as defined under and required by the rules of the Nasdaq Stock Market and the federal securities laws. Our Audit Committee met seven times during 2015.In addition, our Board has determined that both Mr. Henry and Ms. Humphrey qualify as an “audit committee financial expert,” as defined under applicable federal securities laws. Our Audit Committee is directly responsible for, among other things, the appointment, compensation and related audit fee negotiations, retention, and oversight, including selection of the lead engagement partner, and tenure of our independent registered public accounting firm. The oversight includes reviewing the plans and results of the audit engagement with the firm, approving and negotiating any additional professional services provided by the firm and reviewing the independence of the firm. TheIn addition, the Audit Committee is also responsible for discussing the effectiveness of the internal controls over financial reporting, review of significant accounting policies, and discussion of significant judgements or accounting estimates during the audit with the firm and relevant financial management. Our Board The Audit Committee is also tasked with oversight of Directorsthe cybersecurity controls in place at the Company. The Company employs a dedicated Chief Information Security Officer, with an experienced and competent security team, and works closely with the Chief Risk Officer to provide risk reporting and ensure security and compliance. The Company regularly engages third party experts to perform cybersecurity assessments, which are normally performed on an annual basis. Cybersecurity reports are sent to the Audit Committee on a monthly basis, and Security, Risk and Compliance updates are provided quarterly. The Company has determinedimplemented policies and procedures for all employees including; information security/cybersecurity policies (which are internally available for all employees); information security/cybersecurity awareness training; a clear escalation process which employees can follow in the event an employee notices something suspicious; and ensuring that eachinformation security/cybersecurity is a part of Messrs. Henry, Warrenthe employee performance evaluation and/or disciplinary process. The Company maintains a cyber insurance policy and Casper qualifies as an “audit committee financial expert,” as defined under applicable federal securities laws.has not had a security breach and has not incurred any material expenses for a security breach in the past three years. The Audit Committee also provides oversight of the climate related risks at the Company. We do not operate in a high-risk industry for climate risks. We believe that we have low climate risk with respect to our physical environment (e.g. fires, drought, hailstorms, increasing weather pattern changes). A significant portion of our workforce is continuing to work remotely. We have insurance policies in place to cover any damage for our property, plant and equipment. We currently do not have any regulatory emissions reporting obligations. We do not have significant risk from a transition to a low-carbon economy, which could result in changing customer behavior. Compensation Committee.Committee (Number of meetings held during 2023: Four).Our During 2023, our Compensation Committee consistsconsisted of Messrs. David J. JohnsonMs. Humphrey (chair), Jack A.Mr. Henry, Ms. Ward, Ms. Keegan and Ms. Sara R. Dial,Mr. Adame, each of whom the Board of Directors has determined isto be “independent,” as defined under and required by the rules of the Nasdaq Stock Market. Our Compensation Committee met five times during 2015. The Compensation Committee is responsible for, among other things, supervising and reviewing our affairs as they relate to the compensation and benefits of our executive officers and directors.directors, as well as overseeing succession planning for executive officers. In carrying out these responsibilities, the Compensation Committee reviews all components of executive compensation for consistency with our compensation philosophy and with the interests of our stockholders. The Compensation Committee’s charter allows it to delegate any matters within its authority to individuals or subcommittees as it deems appropriate. In addition, the Compensation Committee has the authority under its charter to retain outside advisors to assist it in the performance of its duties. Beginning in the fall of 2009, theThe Compensation Committee has engaged Mercer from time to time as itsperiodically engages an independent compensation consultant and advisor to: | ● | Provide recommendations regarding executive compensation consistent with the Company’s business needs, pay philosophy, market trends and latest legal and regulatory considerations; |

| ● | Provide market data for base salary, short-term incentive and long-term incentive decisions; and |

| ● | Advise the Compensation Committee as to best practices. |

Provide recommendations regarding executive compensation consistent with the Company’s business needs, pay philosophy, market trends and latest legal and regulatory considerations;

Provide market data for base salary, short-term incentive and long-term incentive decisions; and

Advise the Compensation Committee as to best practices.

In 2013, Mercer provided market benchmark information and advised on the competitivenessTable of executive officer compensation. The peer group at that time consisted of the following companies:Contents

| | | • Education Management Corporation

(no longer publicly traded);

• The Advisory Board Company

• DeVry Education Group, Inc.

• Blackboard

• ITT Educational Services, Inc.

• The Corporate Executive Board Company

| | • Strayer Education, Inc.

• Bridgepoint Education, Inc.

• K12 Inc.

• Capella Education Company

• Monster Worldwide

• Apollo Education Group, Inc.

• American Public Education, Inc.

| | | | | | |

As a result of Mercer’s analysis of peer group compensation practices and the Compensation Committee’s assessment of management performance in 2013 and prior years, the Compensation Committee in March 2014 approved increases in executive management base salaries. The Compensation Committee engaged Mercer in the Spring of 2016 to provide market benchmark information and advice on the competitiveness of executive officer compensation. Their report will be provided to the Compensation Committee in May 2016 and the results will be used in making compensation decisions in 2016 or future years.

Nominating and Corporate Governance Committee.Committee (Number of meetings held during 2023: Seven).Our During 2023, our Nominating and Corporate Governance Committee consistsconsisted of Messrs. Bradley A. CasperMs. Keegan (chair), David J. Johnson, Kevin F. WarrenMs. Ward, Ms. Humphrey, Mr. Henry, and Ms. Sara R. Dial,Mr. Adame, each of whom our Board of Directors has determined isto be “independent,” as defined under and required by the rules of the Nasdaq Stock Market. Our Nominating and Corporate Governance Committee met five times during 2015. The Nominating and Corporate Governance Committee is responsible for, among other things, identifying individuals qualified to become members of the Board of Directors; recommending to the Board of Directors nominees for each election of directors; developing and recommending to the Board of Directors criteria for selecting qualified director candidates; considering committee member qualifications, appointment and removal; recommending corporate governance principles, codes of conduct and compliance mechanisms; and providing oversight in the annual evaluation of the Board of Directors and each committee.committee; and overseeing the Company’s environmental and social sustainability initiatives. Information About the Board of Directors The following matrix provides information regarding the members of our Board of Directors, including certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors which our Board of Directors believes are relevant to our business or industry. The matrix does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of the Board of Directors. | | | | | | | | | | | | | Brian E. Mueller | | Sara Ward | | Jack A.

Henry | | Lisa Graham Keegan | | Chevy Humphrey | | Kevin F. Warren | Knowledge, Skills and Experience | | | | | | | | | | | | Public Company Board Experience | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | Financial | ⚫ | | | | ⚫ | | | | ⚫ | | ⚫ | Risk Management | | | | | ⚫ | | | | ⚫ | | ⚫ | Accounting | | | | | ⚫ | | | | ⚫ | | ⚫ | Corporate Governance/Ethics | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | Legal/Regulatory | ⚫ | | | | ⚫ | | ⚫ | | | | ⚫ | HR/Compensation | ⚫ | | ⚫ | | | | ⚫ | | ⚫ | | ⚫ | Executive Experience | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | Operations | ⚫ | | | | | | ⚫ | | ⚫ | | ⚫ | Strategic Planning/Oversight | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | | ⚫ | Technology | | | | | | | | | ⚫ | | | Mergers and Acquisitions | | | ⚫ | | ⚫ | | | | ⚫ | | ⚫ | Cybersecurity | | | | | | | | | ⚫ | | | Academia/Education | ⚫ | | ⚫ | | | | ⚫ | | ⚫ | | | Demographics – Race/Ethnicity | | | | | | | | | | | | African American | | | | | | | | | ⚫ | | ⚫ | Asian/Pacific Islander | | | | | | | | | | | | White/Caucasian | ⚫ | | ⚫ | | ⚫ | | ⚫ | | | | | Hispanic/Latino | | | | | | | | | | | | Native American | | | | | | | | | | | | Gender | | | | | | | | | | | | Male | ⚫ | | | | ⚫ | | | | | | ⚫ | Female | | | ⚫ | | | | ⚫ | | ⚫ | | | Board Tenure | | | | | | | | | | | | Years | 15 | | 11 | | 16 | | 5 | | 5 | | 1 |

Code of Conduct We have adopted a business code of conduct, which applies to all of our employees, directors, and consultants. The code of conduct includes particular provisions applicable to our senior financial management, which includes our Chief Executive Officer, Chief Financial Officer, and other employees including our principal accounting officer, and other employees performing similar functions. A copy of our code of conduct is available on the Corporate Governance section of the Investor Relations page on our website atwww.gcu.edu. www.gce.com. We intend to post on our website any amendment to, or waiver from, a provision of our code of conduct that applies to any director or officer, including our Chief Executive Officer, Chief Financial Officer, and other persons including our principal accounting officer and other persons performing similar functions, promptly following the date of such amendment or waiver.

Risk Oversight Our Board of Directors is responsible for oversight of our risk assessment and management processes. The Board of Directors has delegated to the Compensation Committee basic responsibility for oversight of management’s compensation risk assessment, and has delegated to the Audit Committee tasks related to risk process oversight. In exercising its oversight duties, the Board of Directors receives reports from each committee regarding the committee’s considerations and actions. The Audit Committee’s process includes working with the Company’s Chief Risk Officer and other members of the Company’s enterprise risk management team, meeting periodically with the Chief Risk Officer and other members of management and receiving reports on enterprise risk management, including management’s assessment of risk exposures (including risks related to liquidity, credit, operations, cyber security, climate, and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The Audit Committee may also, from time to time, receive updates between meetings from the Chief Risk Officer, the Chief Executive Officer, the Chief Financial Officer and other members of management relating to risk oversight matters.

Director Nomination Process When selecting nominees for appointment or election to our Board of Directors, our Nominating and Corporate Governance Committee intends to makemakes such selections pursuant to the following process: | ● | Identification of director candidates by our Nominating and Corporate Governance Committee based upon suggestions from current directors and senior management, recommendations by stockholders and/or use of a director search firm; |

| ● | Review of the candidates’ qualifications by our Nominating and Corporate Governance Committee to determine which candidates best meet our Board of Directors’ required and desired criteria; |

| ● | Interviews of interested candidates who best meet these criteria by the chair of the Nominating and Corporate Governance Committee, the chair of our Board of Directors, and/or certain other directors and management; |

| ● | The recommendation by our Nominating and Corporate Governance Committee for inclusion in the slate of directors for the annual meeting of stockholders or for appointment by our Board of Directors to fill a vacancy during the interval between stockholder meetings; and |

| ● | Formal nomination by our Board of Directors. |

identification of director candidates by our Nominating and Corporate Governance Committee based upon suggestions from current directors and senior management, recommendations by stockholders and/or use of a director search firm;

review of the candidates’ qualifications by our Nominating and Corporate Governance Committee to determine which candidates best meet our Board of Directors’ required and desired criteria;

interviews of interested candidates who best meet these criteria by the chair of the Nominating and Corporate Governance Committee, the chair of our Board of Directors, and/or certain other directors and management;

the recommendation by our Nominating and Corporate Governance Committee for inclusion in the slate of directors for the annual meeting of stockholders or for appointment by our Board of Directors to fill a vacancy during the interval between stockholder meetings; and

formal nomination by our Board of Directors.

Although our Nominating and Corporate Governance Committee will review each candidate’s qualifications to determine whether such candidate is appropriate for our Board of Directors, candidates need not possess any minimum qualifications or specific qualities or skills. In accordance with its charter, the Nominating and Corporate Governance Committee’s review and assessment of incumbent directors and proposed nominees includes the consideration of a candidate’s skills, business experiences, and background, which may include with respect to any particular incumbent or proposed nominee consideration of one or more of the following criteria: | ● | The extent of the director’s/proposed nominee’s educational, business, non-profit or professional acumen and experience; |

| ● | Whether the director/proposed nominee assists in achieving a mix of members on our Board of Directors that represents a diversity of background, perspective and experience; |

| ● | Whether the director/proposed nominee meets the independence requirements of the listing standards of the Nasdaq Stock Market; |

| ● | Whether the director/proposed nominee has the business experience relevant to an understanding of our business; |

| ● | Whether the director/proposed nominee would be considered a “financial expert” or “financially literate” as defined in applicable listing standards or applicable law; |

Whether the director/proposed nominee assists in achieving a mix of members on our Board of Directors that represents a diversity of background, perspective and experience;

Whether the director/proposed nominee meets the independence requirements of the listing standards of the Nasdaq Stock Market;

Whether the director/proposed nominee has the business experience relevant to an understanding of our business;

Whether the director/proposed nominee would be considered a “financial expert” or “financially literate” as defined in applicable listing standards or applicable law;

Whether the director/proposed nominee, by virtue of particular technical expertise, experience or specialized skill relevant to our current or future business, will add specific value as a Board member; and

| ● | Whether the director/proposed nominee, by virtue of particular technical expertise, experience or specialized skill relevant to our current or future business, will add specific value as a Board member; and |